free crypto tax calculator australia

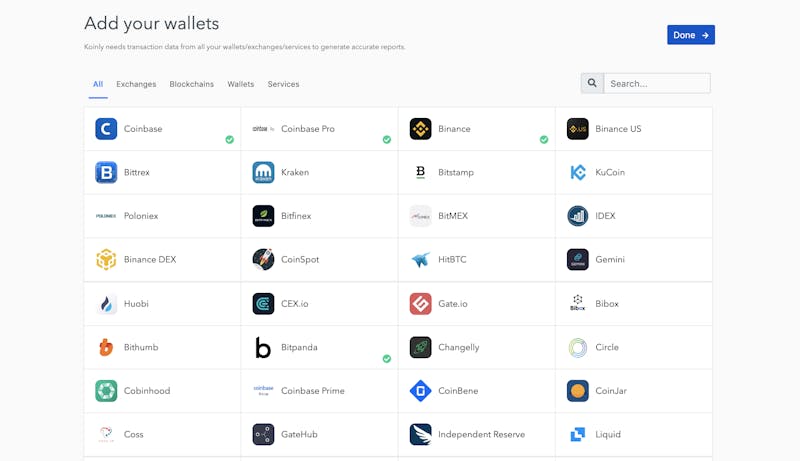

You can discuss tax scenarios with your accountant. Aggregate Your Exchange Data.

Free Crypto Tax Calculator How To Calculate Cryptocurrency Taxes Zenledger

This calculator only provides an indicative estimate based on data you have input and the tax brackets and rates found on the ATO website and does not constitute tax advice.

. Australian Cryptocurrency Record Keeping Made Simple. You buy 1 bitcoin at 10000. Affordable plans for everyone.

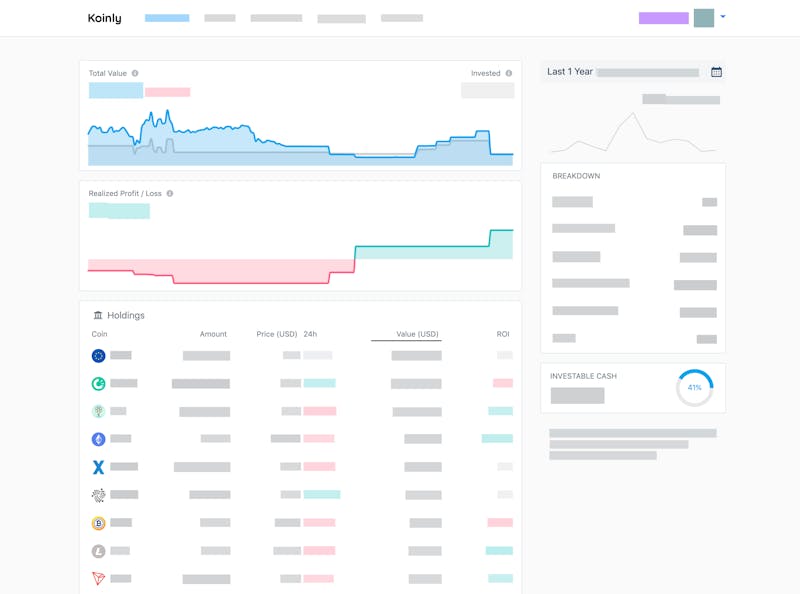

Koinly or Crypto Tax Calculator This report shows your profitloss and capital gains for the financial year. This means you can get your books up to date yourself allowing you to save significant time and reduce the bill charged by your accountant. At Crypto Tax Calculator Australia we believe plans and pricing should be affordable no matter how much you are trading or the amount of transactions you have completed previously.

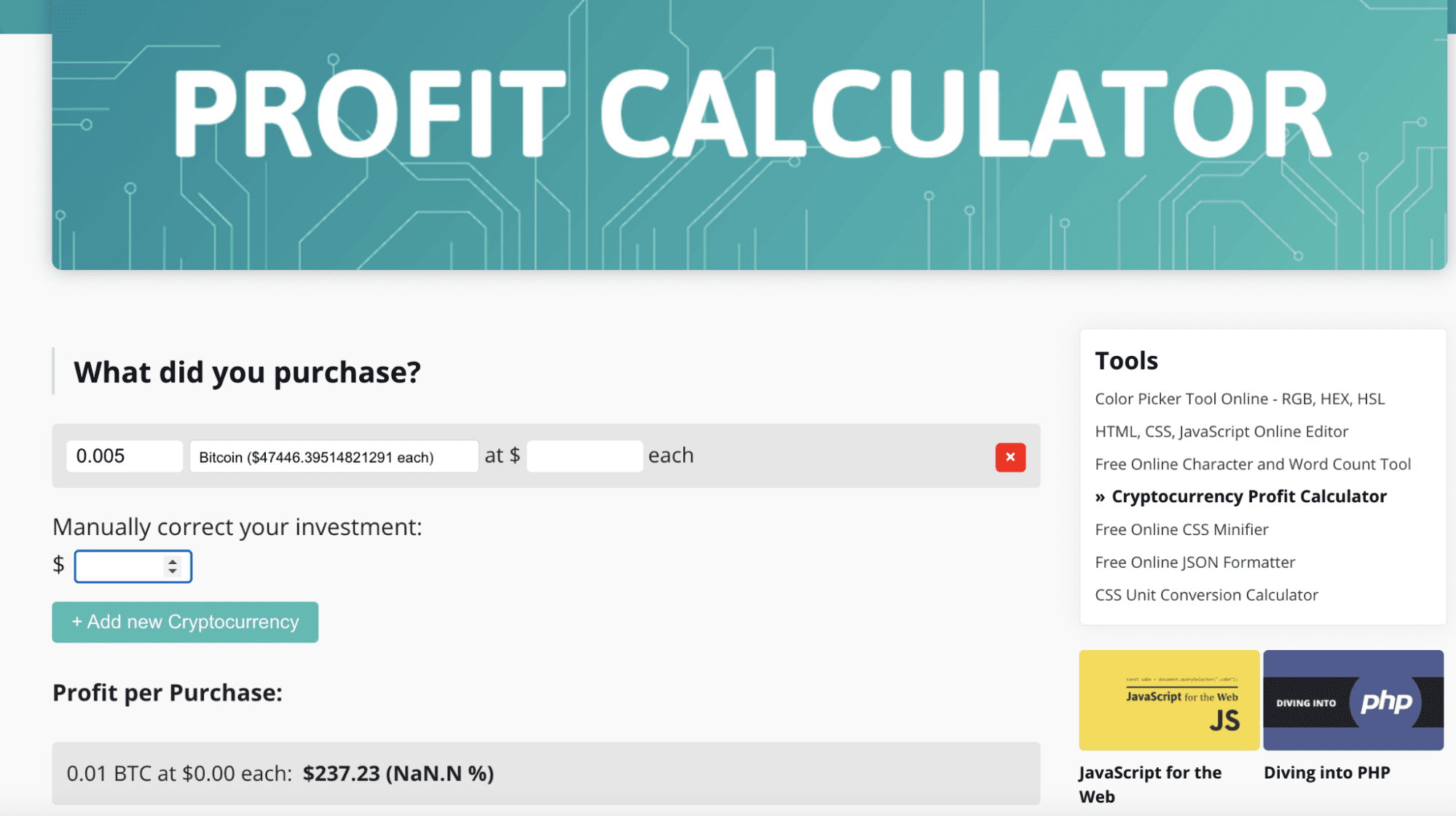

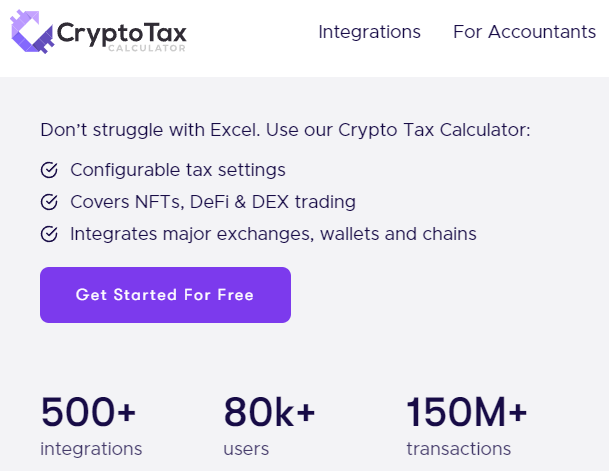

Our crypto tax calculator plans can cost less per year then a subscription to a. Calculate Your Crypto DeFi and NFT Taxes in Minutes. Crypto Tax Calculators annual subscription ranges from 49 to 399 and supports up to 100000 transactions.

Australias Leading Crypto Tax Tool. Rated 46 with 700 Reviews. Use our free cryptocurrency tax calculator below to estimate how much CGT Capital Gains Tax you need to pay on any cryptocurrency sales you made this financial year.

Crypto Tax Calculator who we recommend for our existing users. We have long been committed to offering the most compliant and easy to use crypto platform in the world. A capital gains event only occurs when you do something with your crypto.

Crypto tax software is a tool that allows you to prepare your taxes for your cryptocurrency assets. 5 tax on income from AU45001 to AU70000 which equals to AU8125 in this case. As part of that commitment we are proud to offer all Australian crypto investors an easy solution to filing their taxes.

You simply import all your transaction history and export your report. Were excited to expand our free-to-use crypto tax reporting service to Australia. Create your free account now.

Total income tax will be AU5092AU8125 AU13217. Only capital gains you make from disposing of personal use assets acquired for less than 10000 are disregarded for capital gains tax purposes. Compliant with Australian tax rules.

0 tax on income up to AU18200. Quick simple and reliable. Disposing of cryptocurrency purchased with fiat currency a currency established by a countrys government regulation or law Tim purchased 400 USD Tether USDT for A800.

Australian citizens have to report their capital gains from cryptocurrencies. As part of that commitment we are proud to offer all Australian crypto investors an easy solution to filing their taxes. We use this to.

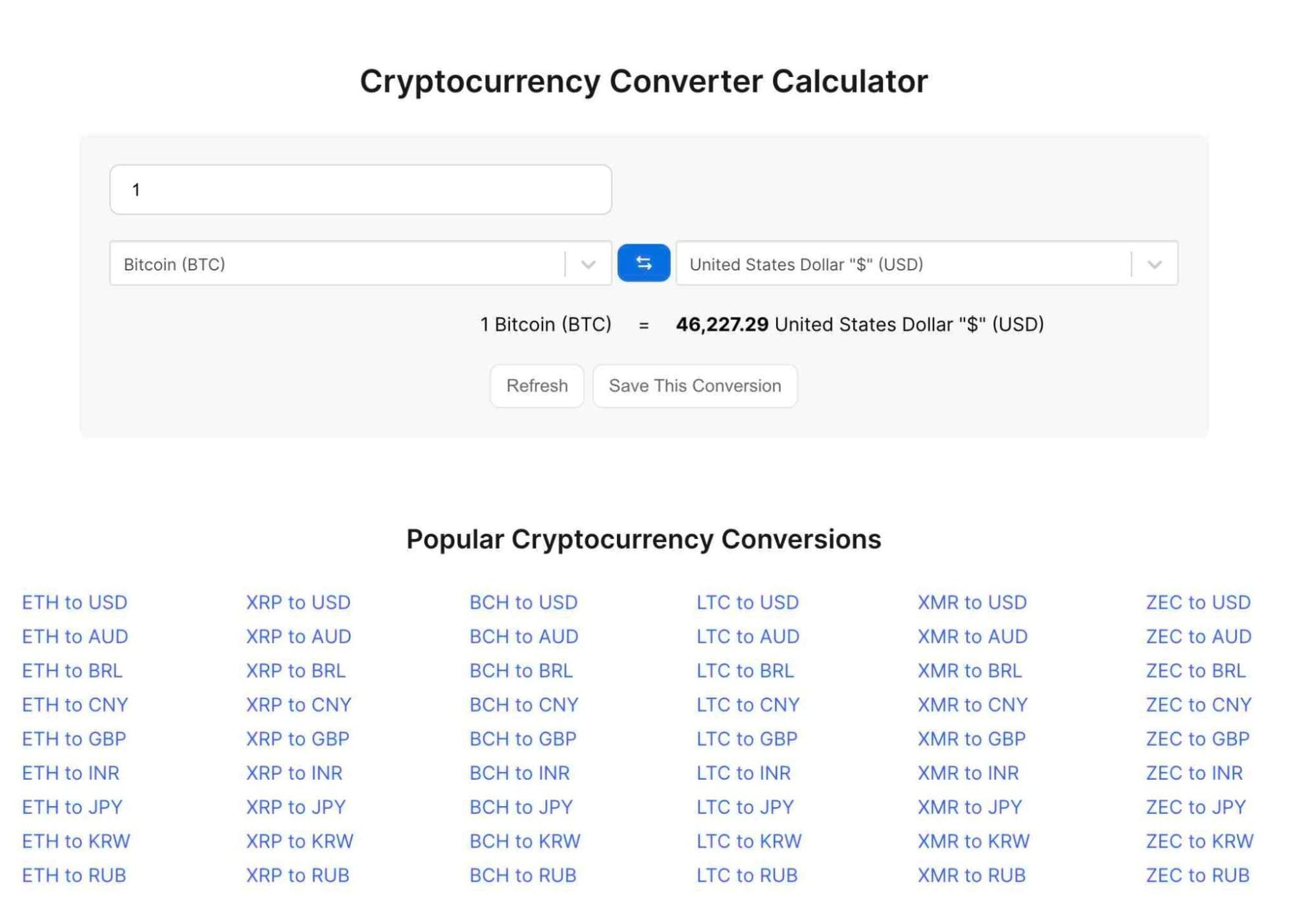

19 tax on income between AU18201 to AU45000 which come to AU5092. Simply import your cryptocurrency data in form of a CSV file and calculate the capital gain taxes in Australia instantly. The rate you pay on crypto taxes depends on your taxable income level and how long you have held the crypto.

Your cryptocurrency tax rate on federal taxes will be the same as your capital gains tax rate. Capital gains tax report. If you make profit on a transaction then youll need to pay tax on your capital gain.

In this case your tax liability will be calculated as follows. June 27 2022. We have long been committed to offering the most compliant and easy to use crypto platform in the world.

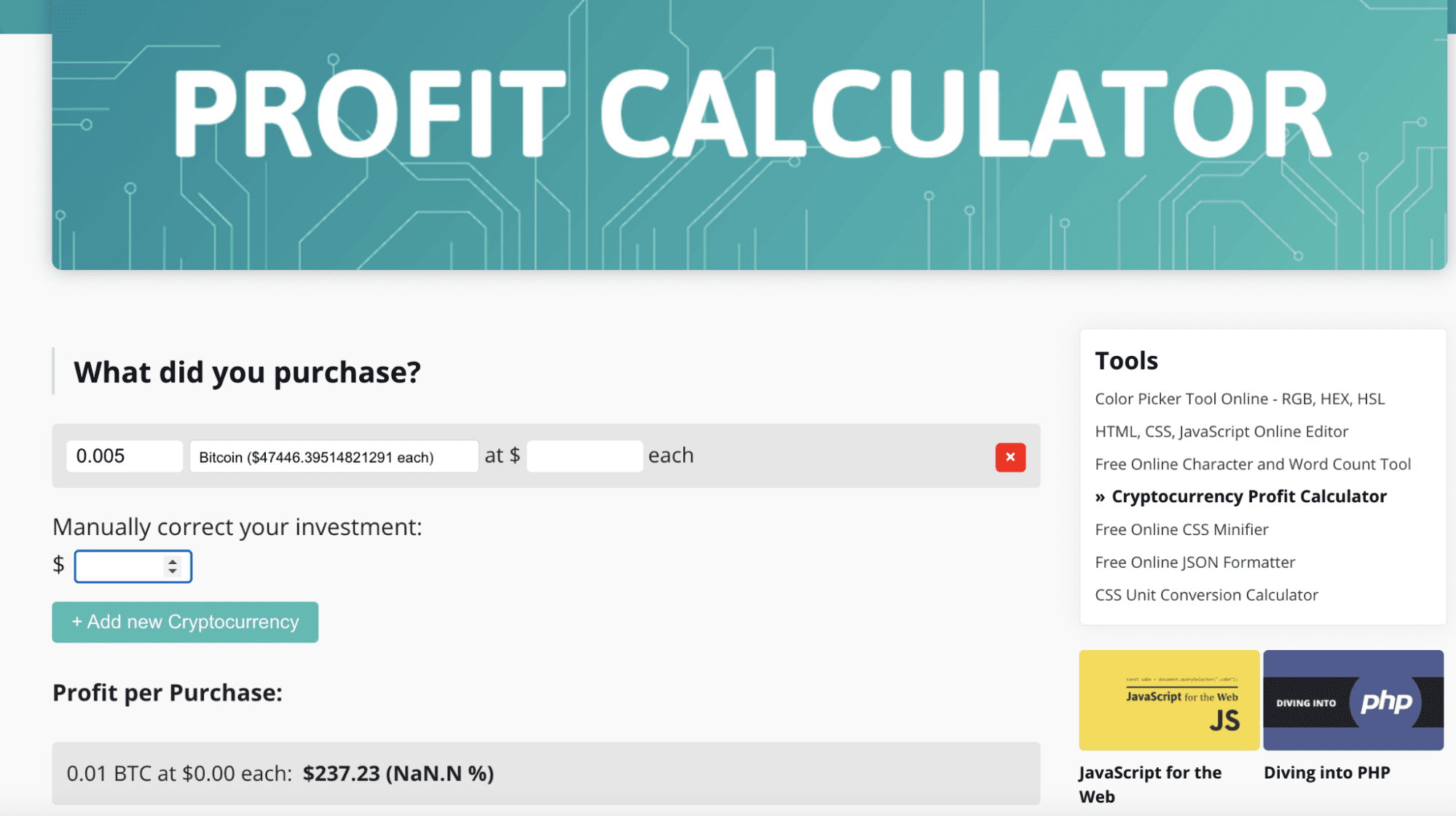

More markets will be added soon said Kris Marszalek Co-founder and CEO of. More markets will be added soon said Kris Marszalek Co-founder and CEO of. It allows you to calculate the profit and loss from cryptocurrency trading calculate capital gains or losses and take deductions on expenses.

Link trades using FIFO LIFO HCFO or a custom method. Here is an example. It takes less than a minute to sign up.

Ideally you should download a crypto tax report from your provider. Dont have an account. As a refresher short-term capital gains had a rate of 10 to 37 in 2021 while long-term capital gains had a rate of 0 to 20.

Over 600 Integrations incl. Our Australian crypto tax calculator is the perfect tool for anyone to calculate their crypto tax. Were excited to expand our free-to-use crypto tax reporting service to Australia.

Check out our free and comprehensive guide to crypto taxes in. Free Trial Up to 50 Transactions 0 Financial Year. A record of all crypto purchases sales and interest earned.

Get Started For Free. Yes CryptoTaxCalculator is designed to generate accountant friendly tax reports. It offers a free trial that allows you to import data review transactions see a full.

In many cases this sort of software also includes a complete crypto portfolio tracker and analysis tool to get a bird eye view of all your crypto. File your crypto taxes in Australia. Here is a list of things you need before you lodge your crypto tax return with Etax.

Not sure how cryptocurrencies are taxed. Coinpanda generates ready-to-file forms based on your trading activity in less than 20 minutes. If you only buy and hold then you dont need to pay tax on your crypto even if the value of your purchased coins has increased.

Calculate Your Crypto Taxes With Ease Koinly

14 Best Crypto Tax Software To Ease Your Calculation And Be Compliant Geekflare

Bitcoin Price Prediction Today Usd Authentic For 2025

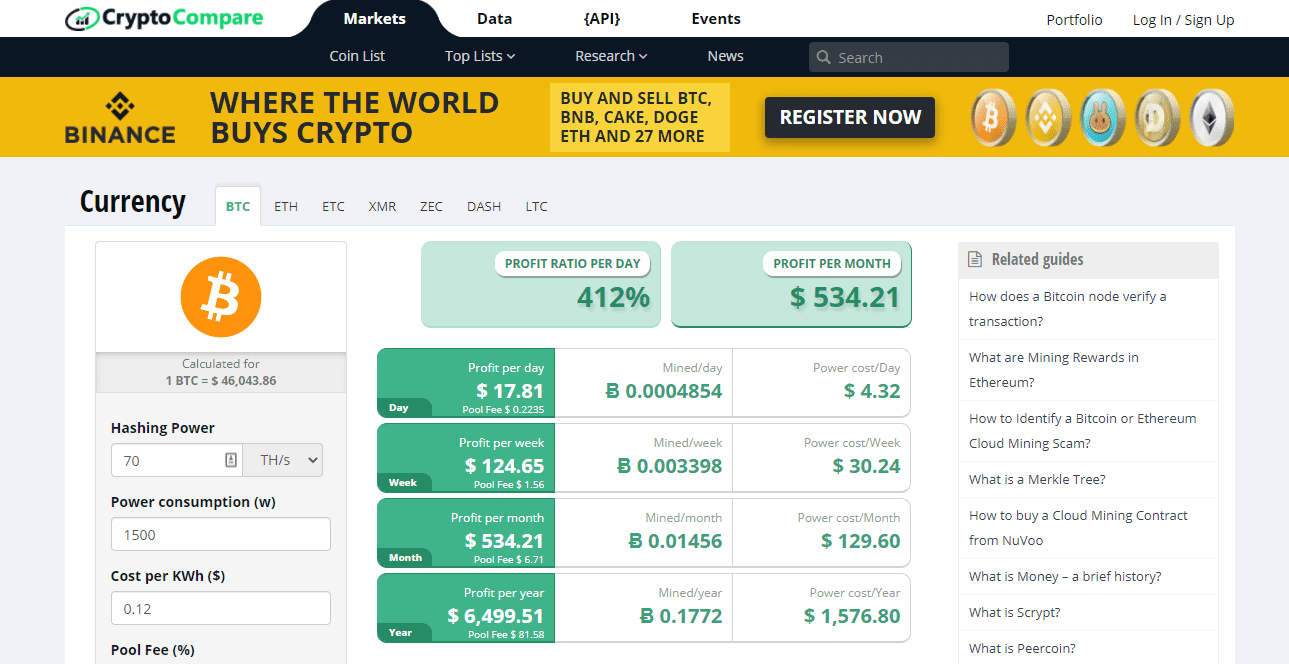

Best Cryptocurrency Calculator Mining Profit Taxes

Best Crypto Tax Software Top Solutions For 2022

14 Best Crypto Tax Software To Ease Your Calculation And Be Compliant Geekflare

Calculate Your Crypto Taxes With Ease Koinly

14 Best Crypto Tax Software To Ease Your Calculation And Be Compliant Geekflare

Calculate Your Crypto Taxes With Ease Koinly

Cryptoreports Google Workspace Marketplace

Best Cryptocurrency Calculator Mining Profit Taxes

How To Calculate Crypto Taxes Koinly

Best Cryptocurrency Calculator Mining Profit Taxes

14 Best Crypto Tax Software To Ease Your Calculation And Be Compliant Geekflare

Malta Based Stasis Launches New Euro Backed Stablecoin Euro Bitcoin Bitcoin Price